Toby Maxwell Talks to Developers

As a prelude to MIPIM being held this month, Toby Maxwell talks to developers, architects and designers realising opportunities in uncertain times.

Uncertain political times have made for less-than-ideal market conditions for the commercial property sector recently, but while business confidence remains muted, there is no shortage of bold and creative developments intended to send out the ‘business as usual’ message.

Last year was one of caution for many in the property development sector, with political uncertainty playing a big part in determining – or rather, stalling – decisions.

The outlook for 2017 carries many of the same unknowns, but despite this, confidence is slowly building once again, and several projects around the world are helping to make the case for optimism among developers, architects and investors alike.

7 Clarges Street, London

7 Clarges Street, London

The past 12 to 18 months have been challenging for property investors. If there’s one thing the market needs to prosper, it is certainty – or at the very least, a sense of relative stability. But at home and abroad predictability is one thing that 2016 most definitely did not deliver. With global political shifts aplenty, financial markets have been lacking the confidence that is conducive to prosperity, and with no-one knowing how the political landscape is likely to play out in the long, medium or short term, it has made for uncomfortable times.

With several major elections upcoming in 2017, increased political uncertainty clearly has the potential to further impact the Eurozone’s fragile economic recovery.

Yet, it may also create opportunities for agile investors. Sentiment in the UK property market is expected to remain volatile while Brexit is being negotiated, and in some of the weaker sub-markets pricing could come under renewed pressure. A series of elections in the Netherlands, Germany and France later this year may also potentially have a short-term cooling effect in these countries. The European Central Bank has kept rates on hold at zero per cent and has prolonged its programme of quantitative easing. Though return expectations on property are being scaled down, real estate remains an attractive value proposition. Capital deployment will continue, although some equity bound to the UK may be targeted at other markets.

In France, Switzerland and Germany, where government-bond yields are trending low to negative, the pressure to invest is being exacerbated, with heightened capital flows expected throughout this year. In 2016, the investment market lost momentum. European investment volumes were at least 20 per cent below the exceptional levels of 2015. Property consultancy Knight Frank’s forecast is that investment activity this year will stabilise at 2016 volumes. It says that a prolonged low interest rate environment will foster further yield compression, although the rate of compression will slow. As rising capital requirements will place banks under pressure to meet lending volumes, global investors will be on the quest for safe assets providing reliable income streams.

Amid the uncertainty, however, there remains much to be upbeat about for developers. Many within the industry believe that UK commercial property will retain its long-term appeal in comparison with other investment opportunities. Commentators highlight the UK’s continued safe haven appeal for investors, driven by high levels of transparency and stable legal structures, and there are plenty prepared to argue that fresh opportunities are cropping up thanks to the changing business climate.

The Exchange, Accra, Ghana – HOK

The Exchange, Accra, Ghana – HOK

Property prospects in the UK are likely to continue to be tempered with reservations about European political uncertainty around Brexit and the great unknown of Donald Trump’s American presidency. But Tony Horrell, CEO UK & Ireland at commercial property consultant Colliers International, maintains that with uncertainty comes opportunity: ‘The UK remains one of the most transparent and active places to do business, and currency arbitrage by international investors is opening up opportunities for new and greater investment, which will no doubt help to drive the UK real estate market in 2017.’

Anthony Duggan, a partner in Capital Markets Research at Knight Frank, is similarly optimistic, pointing out that the danger of Brexit marking the UK out as some kind of loose cannon is put into context by a bigger picture of widespread political risk and uncertainty around Europe and the western world.

‘Combine this with signs that infrastructure spending is rising up the Government’s agenda, a continued low-interest rate environment plus the relative weakness of the currency, there are solid reasons to believe that the UK will remain attractive to global capital.’

There is no denying, however, that it is a muddled picture. For example, a weaker pound may have multiple effects on the UK economy. Some investors will be in wait-and-see mode until the macro environment becomes less clouded, while long-term offshore investors may see the inherent value of UK property in view of the weakening pound and softening values.

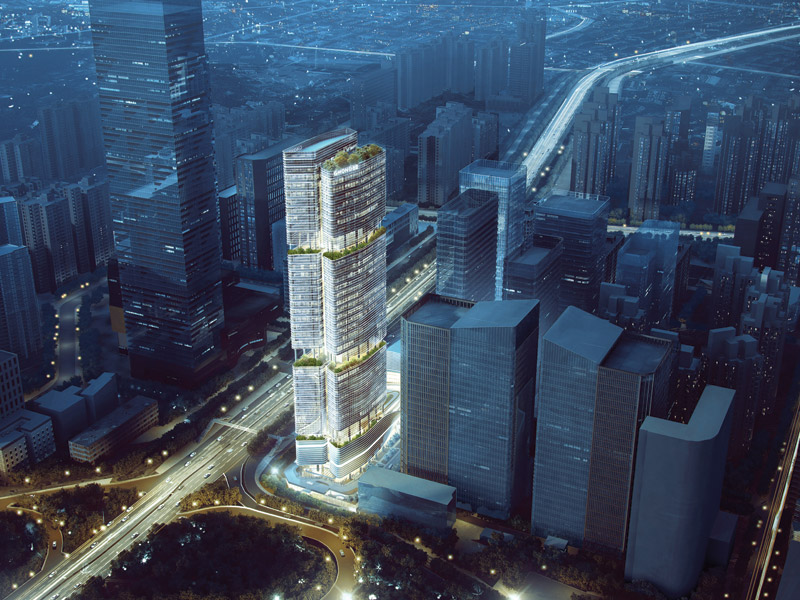

Gmond International Building, Shenzhen, China – Shenzhen Gmond

Gmond International Building, Shenzhen, China – Shenzhen Gmond

There are other trends to keep an eye on too. In the USA, there has been plenty of talk about the move from suburban-style sprawl to more dense communities of different housing arrangements, such as town houses, apartments and single-family homes in the same neighbourhoods. Existing suburban neighbourhoods are adding urban amenities to create environments where people can live, work and play outside of the core part of the city – something that has not always been the case in many areas.

This new ‘surban’ approach is about more than simply mixed-use developments, according to Danielle Leach, a senior consultant at John Burns Real Estate Consulting in Chicago. ‘Surban living is becoming a new way of life for many, where the blend of urban and suburban living provides the best of both worlds,’ she says.

Her practice expects nearly 80 per cent of residential growth to occur in suburban communities over the next 10 years – up from 71 per cent in 2010-15 – compared to just 15 per cent for urban areas through to 2025.

It is also reflecting a shift towards ‘inclusive’ housing, with increasing numbers of developments that include affordable units suitable for potential buyers on lower incomes.

Jumeirah Al Naseem, Dubai, UAE – Jumeirah Group

Jumeirah Al Naseem, Dubai, UAE – Jumeirah Group

There are of course territories that seem to operate above many of the political and economic winds that can buffet the property marketplace in the UK, the USA and Europe. The sheer potential of some of these emerging markets ensures a level of attractiveness for investors, and this, combined with the changing nature of a society becoming more and more connected by technology, will see continued opportunities globally.

According to the UN, 54 per cent of the world’s population currently lives in urban areas, and is expected to reach 66 per cent by 2050.

Some cities have become economic and demographic hubs with a global reach, in some cases surpassing the nation to which they belong. These new world cities are generating geopolitical changes that have an impact on the global economy, and also on the property industry. ‘Megacities’, for example, are emerging at an exponential rate such as Lagos in Nigeria, the most populous city in Africa.

Kinshasa, the capital of the Democratic Republic of Congo, is drawing heavily on the Asian urban development model and recently signed a US$15m contract to develop a new masterplan for the city.

This ‘new deal’ of game-changing factors – technological revolution, geopolitical instability and societal changes – that are sweeping through the business world is at the heart of the theme of this year’s MIPIM, which takes place in Cannes, France. For property professionals, the challenge will be to export their know-how and experience while adapting them to local customs.